take home pay calculator manitoba

This tool will estimate both your take-home pay and income taxes. Additional Claims T1213 Pay Frequency.

Hardiness Zone Map Canada Plant Hardiness Zone Plant Zones Plant Hardiness Zone Map

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. If you earn more than 34431 but less than 74416 your income above 34431 will be taxed at. The Manitoba Income Tax Salary Calculator is updated 202223 tax year.

The Manitoba Annual Tax Calculator is updated for the 202223 tax year. Just select your province enter your gross salary choose at what frequency youre. Ontario Manitoba Saskatchewan Alberta British Columbia Northwest Territories Nunavut Yukon.

This works out to be 1742 per biweekly. You can use the calculator to compare your salaries between 2017 and 2022. That means that your net pay will be 35668 per year or 2972 per month.

Your average tax rate is 314 and your marginal tax rate is 384. If you make 52000 a year living in the region of Manitoba Canada you will be taxed 16332. Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in.

The calculator is updated with the tax rates of all Canadian provinces and. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. You can quickly calculate your net salary or take-home pay using the calculator above.

You can figure out your take-home salary in just a few clicks using our Canadian salary calculator. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. It can also be used to help fill steps 3 and 4 of a W-4 form.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Use our income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax. The average income in Manitoba for adults over the age of 16 is 45300.

Just enter your annual pre-tax salary. That means that your net pay will be 40568 per year or 3381 per month. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Manitoba NB Manitoba Saskatchewan NS. Personal Income Tax Calculator - 2020 Select Province. Personal Income Tax Calculator - 2021 Select Province.

To calculate your estimated annual take home pay see our online canadian tax calculator which is available for all provinces and territories except quebec which has its own. That means that your net pay will be 37957 per year or 3163 per month. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits.

Manitoba take-home pay estimates What is the average salary in Manitoba. You can use the calculator to compare your salaries between 2017 and 2022. Single SpouseEligible dep Spouse 1 Child Spouse 2 Children Spouse 3 Children Spouse 4 Children Other.

The lowest tax rate in Manitoba is 108 for individuals who earn 34431 or less in one year. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Essential Tips To Improve Your Baking Skills Baking Cooking Skills Baking Tips

Handmade Ceabloo Soap Soap Making Soap Handmade

Net Income Tax Calculator Manitoba Canada 2020

Free Seed Starting Calculator Plantertomato Vegetable Gardening Seed Starting Vegetable Garden Planning Vegetable Garden

Pin By Floor Decor Design Center On Luxury Vinyl Tile Luxury Vinyl Tile Flooring Luxury Vinyl Flooring

How Much Does Central Air Conditioning Cost Central Air Conditioning System Central Air Conditioning Cost Air Conditioning Companies

These Are The Best Manitoba Real Estate Agents On Social Media Check Out The Full List Of Top Agents Real Estate Agent Real Estate Estates

Pin On Original Vintage Advertising

Software Engineers The Most Demanded Skilled Workers In Canada Software Engineer Engineering Careers Skills

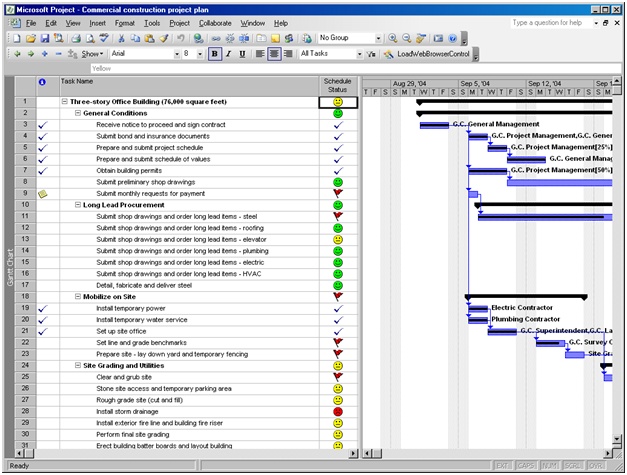

Ms Project Plan For Schedule Status How To Plan Dashboard Template Project Management

Lower Fort Garry Spanish House Old Fort Fort

Retirement Savings Spreadsheet Excel Templates Spreadsheet Template Budget Spreadsheet

Solar Panel Cost In Canada Price Guide And Calculator Solar Panel Cost Solar Panels Solar

Calculator Man Painting Painting Art Artwork

Kitchen Remodel Calculator Bathroom Remodel Cost Cost Of Kitchen Cabinets Financial Calculator

The Homestead Garden Planner Garden Planner Homestead Gardens Organic Vegetable Garden